Best Loan Options in the Philippines: Compare Rates, Fees, and Terms

Finding the right loan in the Philippines can be confusing - rates, fees, and requirements differ across banks, credit unions, and online lenders. This guide breaks down how loans work, where to find personalized offers, and how to compare offers safely.

Why compare loans with Moneezy?

Borrow money the right way – compare easily, quickly and for free with Moneezy.

Moneezy is a leading financial portal operating in over 17 international markets, spanning across Europe, Africa, and Asia. We collaborate with over 200 lenders worldwide to ensure that our users are offered the best terms and loans that fit exactly their needs.

Moneezy is not a lender nor a financial institution, therefore we are not biased when comparing loan offers to our users. We aim to be a trusted partner for people who need to find financing quickly. Our comparison tool is free to use and saves you time and effort by comparing loan terms from top lenders in the Philippines.

Understanding the components of a loan

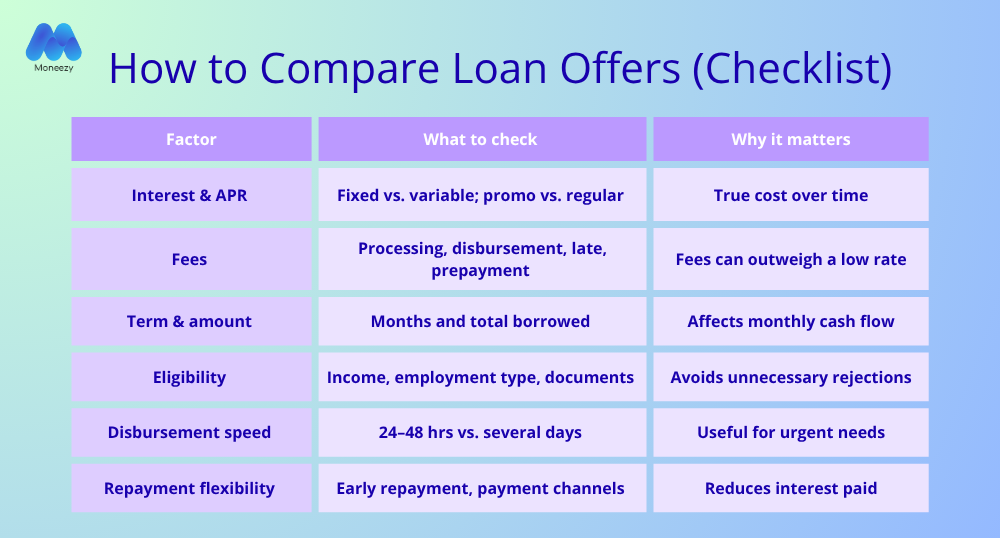

Before taking out a loan, it's important to understand what each component of the loan means. Knowing these basics helps you compare offers and find the loan that matches your needs and budget best.

Here are the key components to look out for:

Loan Amount - How much you borrow

This is the total amount you borrow from the lender, also known as the principle.

Loan Term - how long you’ll repay the loan

The time you have to repay the loan is usually from 1 to 72 months.

Monthly Repayment – the amount you repay every month

This is the amount you’ll pay each month. It includes both principal and interest.

Interest Rate – the basic cost of the loan

The interest rate is the percentage the lender charges you on top of the loan amount.

Fees and Charges – any additional costs of the loan

Some loans come with processing fees, late payment charges, or early repayment penalties.

Total Cost of the Loan – how much the loan will cost you

This is how much you’ll pay in total by the end of the loan term, including the loan amount, interest, and any fees.

APR (Annual Percentage Rate) - total cost of the loan in percentage

Often presented in a percentage, APR shows the total cost of the loan. It includes the interest rate plus any additional fees that the loan may have.

Understanding these elements helps you take smart financial decisions when choosing the loan that’s right for you. Read more about interest rate and the cost of a loan here.

Before you take a loan

Here’s what you should think about before you apply for a loan.

Make a budget

Before taking out a loan, make a monthly, quarterly and annual budget. Check your income and expenses and calculate what monthly repayments you can make comfortably. Always choose repayment plans that fit your budget.

Calculate exactly how much you need to borrow

It can be tempting to borrow a bit more money just to be sure you have enough, or just for fun, but it’s a very bad idea. Only borrow money that you really need, and you can afford to repay it.

Use a loan calculator for the Philippines

Every lender provides you with a loan calculator on their website. A loan calculator helps you estimate the total cost of the loan, and your repayment schedule. Simply enter your desired loan amount and repayment period, and you’ll instantly see how much you need to pay each month.

Can I see a loan agreement sample?

Once you apply for a loan and you are approved, the lender will send you a copy of the loan agreement before you proceed. This includes all the important details, e.g. loan amount, interest rate, fees, repayment schedule, and terms. Make sure to read everything carefully before signing.

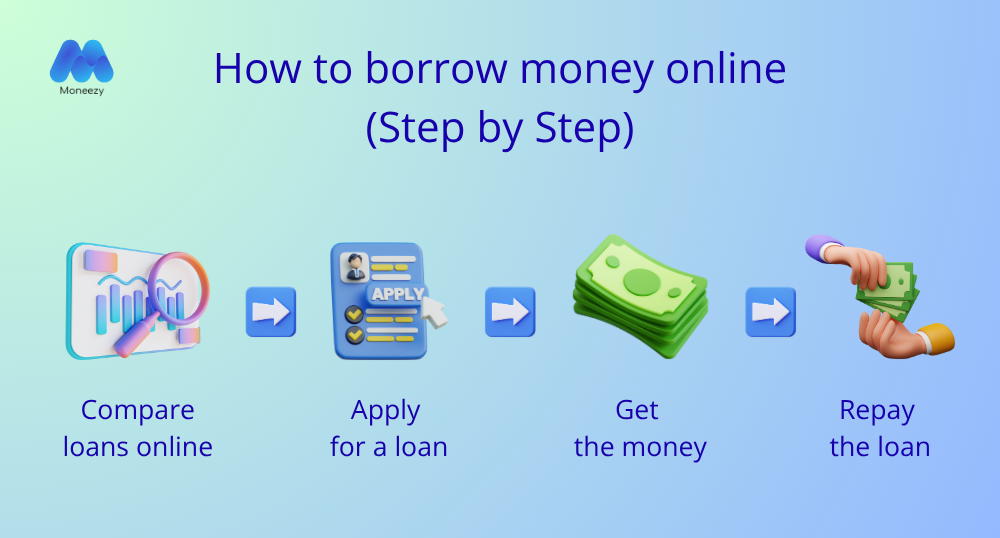

Step by Step – How to borrow money online?

Fill out Moneezy’s online application and compare the loan offers you receive.

Send your application directly to one or more of the lenders you are matched with and wait for their response to your application.

Sign the loan offer that fits your finances best and receive the money shortly.

Make sure you pay your loan instalments every month.

Loan repayment in the Philippines

What are your repayment options?

Different lenders have different repayment options, but the most popular ones include weekly, bi-weekly, or monthly. Choose how often you repay based on your cash flow and what works best for your budget.

The most common loan repayment methods in the Philippines are e-wallets & online banking, and payment centres.

Full loan repayment

Ready to finish your loan? Most lenders let you repay your loan in full at any time. Depending on the loan offer you signed, you may even save on interest or fees.

What if you can’t make a payment?

No matter how much we try, sometimes life just happens, and unexpected expenses may make it hard to make the next payment.

In such cases, contact your lender as soon as possible to see how you can resolve the situation and avoid extra fees or penalties.

If you reach out in good time, most lenders will offer some kind of a solution, either by suggesting a minimum payment, moving the payment day or offering you a new repayment plan that better fits your situation.

Advantages and disadvantages of borrowing money online

Simple lending process

Fast payout

Flexible repayment terms

Easy to compare offers and lenders

Higher interest rates

Extra fees may be charged

Limited loan amounts

Risk of loan scams

Advantages of online loans

Simple lending process

The easy online application process allows you to borrow money from any place in the Philippines. Available 24/7, you can fund your next project or cover an unexpected expense in a matter of minutes.

Fast payout

Fast application, fast approval, fast payout. Everything about borrowing money online is optimized so that you can get an instant loan. Still be careful and take your time to compare loan offers and understand the terms of the loan you decide to sign.

Flexible repayment terms

It’s up to you whether you prefer a shorter loan term to pay less interest, or a longer term to keep your monthly payments smaller. Such flexibility makes it easier to fit your monthly repayments into your budget.

Easy to compare offers and lenders

There is a wide choice of lenders online, all of them fighting to offer the best terms and conditions. Platforms such as Moneezy, make it easy for the user to compare trusted loan providers and personalized offers.

Disadvantages of online loans

Higher interest rates

Online loans are loans that don’t require collateral, such as a home, car, etc. That makes it more uncertain for the lender that the loan will be repaid. Thus, short-term loans have higher interest rates and cost more than bank loans. To find the best rate, always compare loan offers from different online lenders.

Extra fees may be charged

Online loans often have more fees, like processing and service ones, or late repayment penalties. Again, this is because loans without collateral are riskier for the lenders. To make sure you get the best conditions and avoid extra fees, always compare loan offers and read the full loan agreement.

Limited loan amounts

Online loans offer limited loan amounts, especially for first-time borrowers. You have to build a good repayment record before you are offered bigger loans. However, first-time borrowers can often enjoy more favorable terms such as a low interest rate on their loan.

Risk of loan scams

When borrowing online, it’s important to make sure the lender is a legit and trusted company. In the Philippines, all lenders must be registered with the Securities and Exchange Commission (SEC) and have their own SEC Registration Number stated on their website. Always check this before applying for an online loan to make sure you’re borrowing from a legitimate and trusted source.

Find the best loan in the Philippines! Moneezy only works with lenders registered with SEC.