Table of contents

- What are loan apps?

- Why do Filipinos use loan apps?

- Cons and risks of loan apps

- Falling into dept

- Loan apps are allowed to send you offers and promotions

- Loan apps and data privacy

- What data do legit loan apps collect, and why?

- Loan apps are legally required to collect and report data:

- For how long do online loan apps save your data?

- Loan apps data collection: What to watch out for?

- Legit online loan apps in the Philippines: SEC registered loan apps

- What does SEC registered loan apps mean?

- What does the SEC registered loan app protect you from?

- Best Loan Apps in the Philippines

In this article you will find:

In the recent years, loan apps have taken over the online loans market in the Philippines, offering fast and easy access to money from the smartphone. For many Filipinos, these apps have become a convenient solution for unexpected expenses, emergencies, or simply bridging financial gaps between paydays.

While loan apps offer convenience and speed, borrowing money is not something one should just do, without thinking about their financial situation. From high interest rates to privacy concerns, borrowing money from a loan app should be a well-considered decision.

What are loan apps?

Loan apps are mobile applications that allow people to apply for and receive loans quickly, entirely online. Once you have downloaded a loan app and submitted your personal information, you can quickly apply for loans and get approval within minutes.

These apps usually offer small loan amounts, ideal for emergencies or short-term cash needs. While they’re convenient, loan apps often come with higher interest rates and fees compared to traditional bank loans.

Why do Filipinos use loan apps?

Speed and convenience are the biggest reasons why many Filipinos turn to loan apps. The app lets you apply at anytime, anywhere. Online lenders have automated processes that can approve loan requests within minutes.

On top of the minimal paperwork, loan apps do not require collateral, which makes them even more appealing, especially in emergency situations.

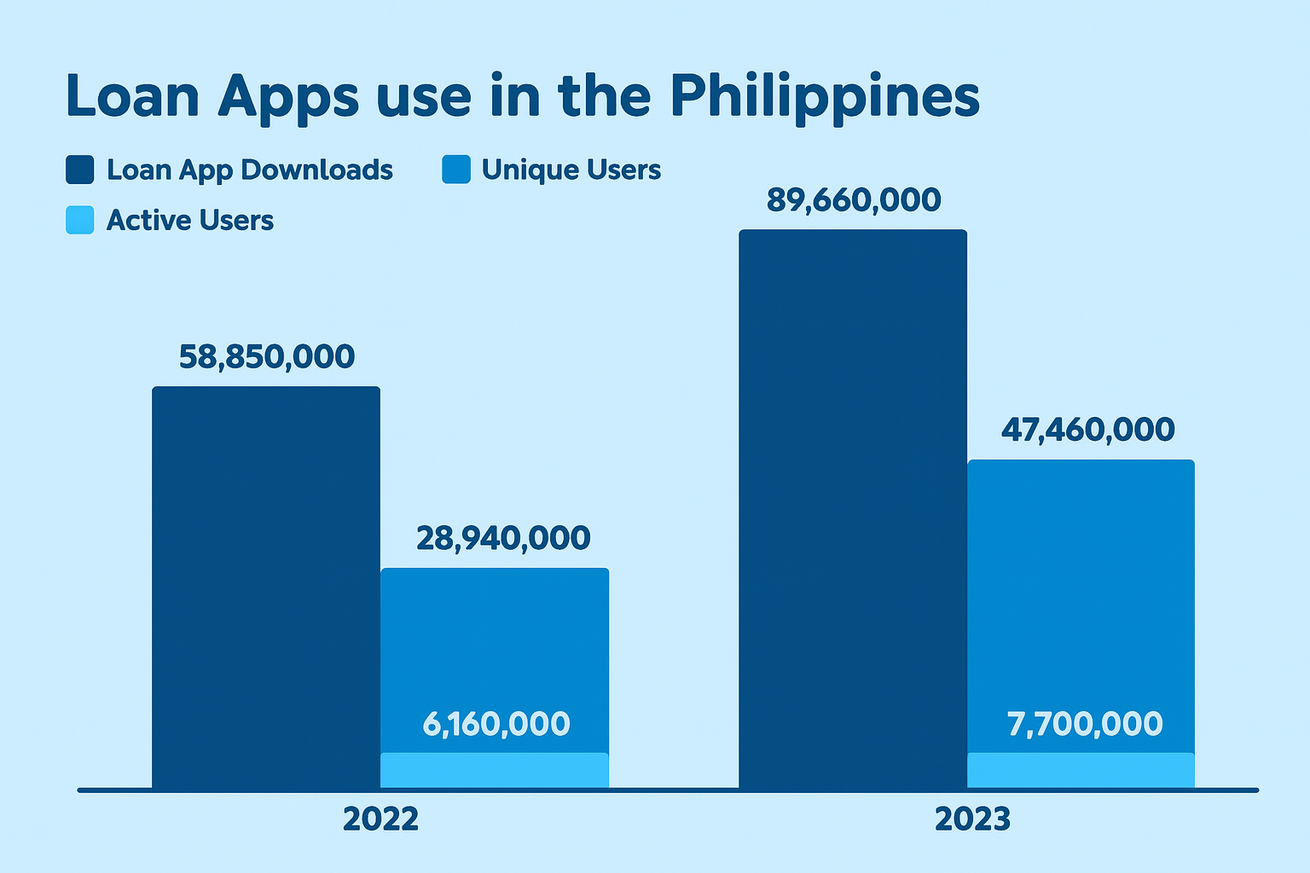

According to Asian Banking & Finance, in 2023, digital lending app downloads in the Philippines reached 89.66 million. This marks a 52% increase from the previous year.

The same study indicates that the number of unique users in 2023 rose by 64% to 47.46 million, while active users increased by 25% to 7.7 million.

Crowdfund Insider highlights that, in 2023, on average loan app users spend about 14 minutes and seven seconds per month on the platforms. This marks a 37-percent surge from the previous year.

This significant growth in the use of online lending apps reflects the increasing reliance on digital lending platforms among Filipinos, driven by factors such as the convenience of online applications and the accessibility of credit services.

In addition, any Filipinos have more than one loan apps downloaded on their phone.

Most loan apps offer low interest rates for first time borrowers, while for repeated clients they offer higher loan amounts. Such general conditions motivate people to download multiple loan apps at the same time.

But what does that mean for the user’s privacy?

Cons and risks of loan apps

The two biggest risks of loan applications are that users can easily fall into debt and data privacy.

Falling into dept

While loan apps offer great flexibility and convenience, they might end up being a bit too convenient, leading to hasty financial decisions.

When borrowing money is so easy that all you need to do is press a few buttons on your phone, it’s tempting to make impulsive choices, like taking out a loan to fund purchases you might not truly need. Serious financial decisions can feel casual and rushed, simply because the process is so quick and accessible.

Such unconsidered loans can end up costing more than expected. For example, if you don’t read the loan agreement carefully, you might overlook fees, high interest rates, or strict repayment schedules. Missing a payment could result in expensive penalties and bigger dept.

Loan apps are allowed to send you offers and promotions

Just like any other app, quick loan apps always ask for permission to send you notifications with updates, offers, and relevant promotions. While this request might seem harmless, constant notifications can tempt you into borrowing money you don’t actually need.

These notifications, especially the ones advertising low-interest loans or limited-time deals, can create a sense of FOMO (Fear of Missing out), making you feel pressured to take out a loan simply because the offer might disappear.

Just because it’s easy to borrow money doesn’t mean it’s always the right choice.

Take time to consider if you really need a loan, then remember to review the terms and the total cost of the loan.

Loan apps and data privacy

Another major concern when it comes to loan apps is data privacy.

All legitimate loan apps have privacy policies that explicitly state what data they collect, how they process it, and if they share it with third parties. Legit lenders only collect data that is necessary for your loan approval and release and protect your data under privacy laws.

What data do legit loan apps collect, and why?

Legit loan apps collect certain types of data to process your loan safely and legally:

ID Data: Your ID, name, birth details, and photo - to confirm your identity and follow laws such as anti-money laundering rules.

Background Data: Income, job, loan purpose, credit history - to check if you’re eligible for a loan.

Contact Details: Your phone number, email, and address - to stay in touch with you.

Transaction Data: Your app logins, payments, transfers - to process your loan and keep records of your transactions.

Interaction Data: Messages, calls, chats, surveys within the app - to help with customer service and communication.

Device Data: Information about your phone, location, apps - to keep the app safe, fix errors, and prevent fraud.

Loan apps are legally required to collect and report data:

Loan apps conduct a KYC (Know Your Customer) screening. This is the process of verifying a customer's identity to prevent fraud, money laundering, and other financial crimes

Loan apps are required to report credit and tax data to agencies like the Credit Information Corporation (CIC) and the Bureau of Internal Revenue (BIR).

For how long do online loan apps save your data?

Usually, online loan apps keep your data for as long as you have an account with them.

If you delete your account, the loan app is required to store your account data for five years from the date that your account is closed. This is a requirement under anti-money laundering laws.

Loan apps data collection: What to watch out for?

Before using any loan app, research the company, read their privacy policy, and only provide data that’s necessary for your loan application. It is your own responsibility to protect your personal information.

Avoid apps that demand too much access without a clear reason. Here is what to watch out for when it comes to cash loan apps and data collection:

Excessive Permissions & Privacy Risks

Some apps might ask for access to your contacts, messages, photos, or location.

Some shady lenders use your contact list to harass friends or family if you miss a payment.

Legit loan apps follow the Data Privacy Act of 2012 and do not engage in abusive collection practices.

Some apps might share or sell your personal data to other companies for marketing or other purposes.

Legit online loan apps in the Philippines: SEC registered loan apps

SEC-registered loan apps are lending companies that are officially registered with the Securities and Exchange Commission (SEC) in the Philippines. Being registered means they have a legal license to operate and must follow strict rules to protect borrowers.

What does SEC registered loan apps mean?

First of all, a SEC registered loan app means that the company that owns the app has a Certificate of Authority (CA) to operate as a lending or financing business in the Philippines.

Second, legit loan apps must follow the Lending Company Regulation Act of 2007 and the Data Privacy Act of 2012 to prevent abusive practices related to debt collection.

Third, loan apps registered with the SEC are required to disclose interest rates, fees, and terms clearly to borrowers.

Lastly, they have clear policies on keeping your data safe.

What does the SEC registered loan app protect you from?

Loan scams - helps you avoid fake apps and loan scams.

Excessive interest rates and fees - SEC regulations and rules help keep interest rates and fees within legal limits.

Harassment and privacy violations - legit lenders can’t use harassment or threats to collect debts, nor can they misuse your personal data.

Hidden charges - registered lenders must be transparent about all fees and repayment terms.

Best Loan Apps in the Philippines

Choosing the best loan app in the Philippines isn’t just about finding the fastest cash, it’s about safety, fairness, and financial peace of mind. The best loan apps are transparent, regulated, and respectful of borrowers’ rights.

The right choice of a loan app depends on your needs, loan amount, and repayment capacity. Take time to compare your options to find one that’s safe and suits your needs.

Here are some of the most popular and reputable loan apps in the Philippines, known for fast processing and transparent terms: Tala, Digido, Finbro and Cashalo.

Desi Rasmussen is a FinTech Communication Specialist with more than eight years of experience in FinTech and SaaS industries. She holds a degree in International Marketing and Communication from the University of Southern Denmark and is passionate about writing content that empowering readers to make smart financial choices.