Table of contents

Online lending in the Philippines has skyrocketed over the past few years, reshaping how Filipinos access financial services.

Asian Banking & Finance predicts that the digital lending market could exceed $1 billion in the second half of 2025, signalling even bigger changes on the horizon.

Adoption of FinTech services in the Philippines: Statistics for 2024

Data from 2024, reported by TNGlobal, paints a vivid picture of how deeply fintech services have become embedded in the everyday life of the Filipinos.

Driven by convenience and growing trust in digital platforms, the fintech adoption through mobile apps reached nearly 80% among Filipino consumers.

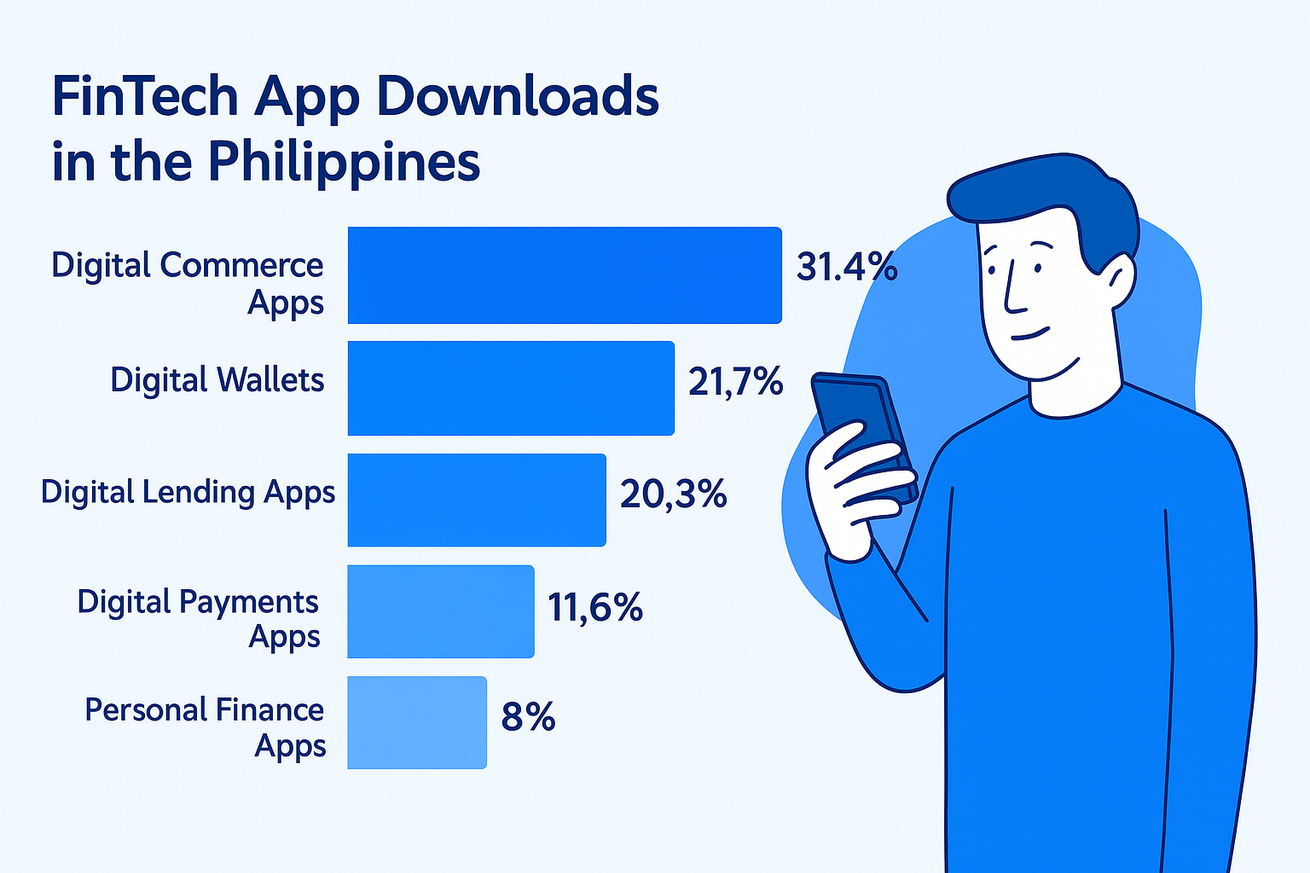

In the landscape of digital services, digital wallets added up for 21.7 percent of the app downloads in the Philippines. Shortly followed by digital lending apps at 20.3 percent. Meanwhile, apps for digital payments and transfers made up 11.6%, personal finance apps took 8%, and digital banking apps claimed 7% of app downloads.

These numbers reflect a shift in consumer behavior, where Filipinos increasingly prefer fast, digital solutions over traditional banking processes.

The rise of loan apps and online loans

The lending landscape in the Philippines is now dominated by mobile-first experiences.

According to Daily Guardian PH, in 2024, Filipinos collectively spent around 49 years on lending apps (1.54 billion seconds).

The analysis, which tracked 47 SEC registered loan apps in the Philippines, revealed that user activity spent on Personal Loans accounts for 76.4% of the time the apps, followed by Buy Now, Pay Later (BNPL) services at 21.4%.

Filipinos can now apply for a loan, get approval, and receive funds within minutes, right from their smartphones. However, this convenience also comes with risks, including higher interest rates and potential data privacy issues, underscoring the importance of responsible borrowing.

Online lending opens for financial inclusion and new borrower segments

One of the most positive outcomes of the digital lending boom has been greater financial inclusion. Many Filipinos who were previously had limited access to bank loans are now able to access loans through digital apps.

Digital lenders have made it easier for workers in informal sectors, freelancers, and small business owners to get credit.

Loan apps assess borrowers based on their income and credit score, however, the lenders are willing to take bigger risks lending money than traditional banks.

Predictions for 2025: Where is digital lending headed?

As we look to 2025, several major developments are likely to shape the digital lending landscape in the Philippines:

Market Size Could Exceed $1 Billion

Industry forecasts suggest that the Philippine digital lending market could surpass $1 billion in H2 2025, reflecting continued growth in consumer lending. Asian Banking & Finance

Rise of AI and Personalization

With AI technologies developing by the minute, we can expect more apps to use AI algorithms to approve loans faster and offer personalized rates based on each borrower’s profile.

Alternative Credit Scoring

Apps may increasingly leverage non-traditional data sources, such as mobile usage and e-wallet activity, to assess creditworthiness, making loans accessible to even more Filipinos.

Tighter Regulation

The Securities and Exchange Commission (SEC) and Bangko Sentral ng Pilipinas (BSP) are likely to implement new and stricter guidelines to protect consumers, especially regarding data privacy and collection practices.

Conclusion: The future of digital lending in the Philippines

The numbers speak for themselves: Filipinos are spending more time than ever engaging with digital lending apps, and the market shows no signs of slowing down.

2024 has been a landmark year for online lending in the Philippines, setting the stage for even more dramatic growth in 2025.

As loan apps and online loans continue to reshape how Filipinos borrow money, borrowers need to be careful, stay informed, and responsible. The future of lending is digital, but it’s important to build it on strict loan regulations and responsible borrowing practices.

Desi Rasmussen is a FinTech Communication Specialist with more than eight years of experience in FinTech and SaaS industries. She holds a degree in International Marketing and Communication from the University of Southern Denmark and is passionate about writing content that empowering readers to make smart financial choices.