Table of contents

- Online lending in the Philippines 2024

- Consumer demographics 2024: Who borrowed the most money in the Philippines?

- Online loan purposes; Why Filipinos borrow money?

- Rising confidence: How Filipinos view online lending in 2024

- Conclusion: The Philippine digital lending market is set to expand even further

In this article you will find:

Highlights from The Philippine Digital Lending Industry Report 2024 and The Philippines Fintech Report 2024

Online lending in the Philippines 2024

The digital lending industry in the Philippines has exploded in recent years, transforming how Filipinos access credit. According to the Philippines Fintech Report 2024, over 300 companies are currently innovating in the FinTech landscape in the country. 73 of these companies offer diverse loan products, ranging from personal and quick loans to business financing.

Lending fintech companies have become essential in bridging the financing gap in the Philippines. These online lenders play a crucial role in providing financial access to small and medium-sized businesses and underserved consumers who often lack the means or eligibility to secure credit through traditional banking channels.

But who exactly is borrowing the most money and why? Understanding the profiles and motivations of these borrowers offers crucial insights into the country’s financial trends and the future of digital lending in the Philippines.

Consumer demographics 2024: Who borrowed the most money in the Philippines?

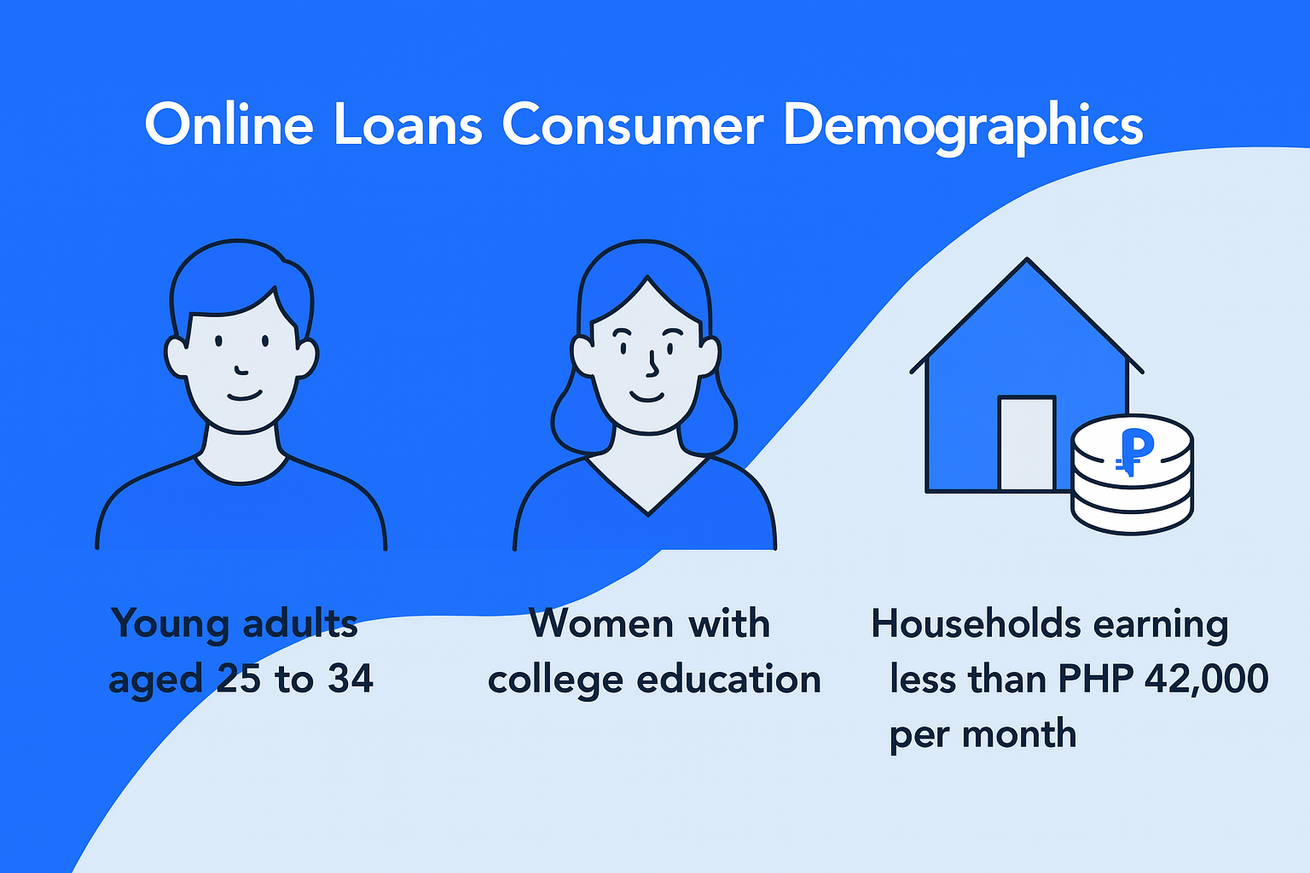

Latest data, reported by the 2024 Philippine Digital Lending Industry Report, a large share of online loan borrowers in the Philippines are young adults aged 25 to 34. The majority being women living in urban areas who have college education.

87% of respondents confirmed that they would not have convenient or accessible credit without online loans.

Most borrowers come from households earning less than PHP 42,000 per month and typically live in families of two to six members.

Online loan purposes; Why Filipinos borrow money?

Most Filipinos turn to online lending for urgent needs, such as emergency medical expenses, paying utility bills, school fees, or covering day-to-day living costs when cash runs short. For many, these loans act as a financial safety net, offering quick solutions during unexpected situations.

Borrowers place high value on low interest rates, fast access to funds, and clear, transparent costs. The convenience of applying online, minimal paperwork, and rapid approvals make digital loans an attractive alternative to traditional bank loans.

Additionally, some Filipinos use online loans to support small business ventures, make home improvements, or consolidate existing debts. The flexibility and accessibility of digital lending platforms continue to make them a popular choice for those seeking immediate financial assistance.

Rising confidence: How Filipinos view online lending in 2024

Filipinos are becoming increasingly informed and confident when using online lending platforms. 90% of respondents, to the 2024 Philippine Digital Lending Industry Report, reported being clearly aware of interest rates, fees, and charges, highlighting substantial progress in transparency across the industry. This suggests that borrowers are not only more financially literate but also more cautious about the true cost of borrowing.

In terms of satisfaction, 89% of respondents reported being pleased with their digital lending experience, citing factors such as convenience, speed of approval, and minimal paperwork. Moreover, 76% expressed willingness to consider future loans from their current digital lenders, indicating growing trust and loyalty toward these financial platforms.

Conclusion: The Philippine digital lending market is set to expand even further

Driven by innovation, financial inclusion, and evolving consumer behavior, the Philippine online lending market is set to expand even further.

As online lending continues to reshape the financial landscape in the Philippines, it’s clear that Filipinos are becoming increasingly informed and confident in how they borrow money.

With growing awareness of interest rates and fees, high levels of user satisfaction, and rising trust in digital platforms, the industry is well-positioned for further growth.

Yet, this progress also comes with important responsibilities. Lenders must maintain transparency, protect user data, and offer fair terms, while borrowers should remain vigilant and borrow wisely to avoid financial pitfalls.

Desi Rasmussen is a FinTech Communication Specialist with more than eight years of experience in FinTech and SaaS industries. She holds a degree in International Marketing and Communication from the University of Southern Denmark and is passionate about writing content that empowering readers to make smart financial choices.