Personal loans – finance your next project

A personal loan is a type of unsecured credit offered by financial institutions and online lenders. Often, they have short term and no collateral, thus the loan amount is smaller than a bank loan.

What can you use personal loans for?

Filipinos use personal loans for various needs; here are some of the most common ones:

Multipurpose loan

A multi-purpose loan is a flexible personal loan for any financial needs you may have, for example managing everyday expenses or upgrading your lifestyle. A multipurpose loan is often used to cover one-time purchases, events & celebrations, or personal projects.

Emergency loan

An emergency loan offers quick access to money exactly when you need it. Ideal for unexpected bills, urgent repairs, or unforeseen expenses. Take an emergency loan to cover your unanticipated expenses in the Philippines.

Business capital loan

Do you have a great business idea? Designed for small business owners or startups, you can finance your initial or current costs, such as inventory and equipment.

Medical expenses loan

Supplement your income in case of healthcare costs with manageable monthly payments. Cover hospital bills or ongoing treatment costs in the Philippines with a fast medical loan.

Tuition or education loan

Invest in your future with an education loan to pay off your tuition fees, schoolbooks, and supplies. A tuition loan with flexible terms is perfect for college students who want to make a bit more room in their budget.

Home repairs or renovations loan

Home repairs often have unforeseen extra expenses. A quick renovations loan for your home in the Philippines can help you finish your project in time and enjoy the comfort of your modernized home.

Home appliances loan

Is your old appliance costing you more than it’s worth? Consider upgrading your refrigerator or washing machine to save energy and lower your electricity bills.

Vacation or travel loan

Upgrade your vacation with a travel loan that spreads out your expenses and allows you to plan your family trip or beach getaway, exactly the way you want it to be.

Wedding loan

Plan your big day with confidence. A wedding loan with monthly instalments can cover venue costs, catering, outfits, and other essentials, giving you the freedom to focus on making memories.

Debt consolidation loan (paying off other loans or credit cards)

Do you struggle to keep an overview of multiple loans or credit card bills? Take control of your finances, instead of juggling different lenders, due dates and interest rates. Simplify your budget with a dept consolidation loan and get only one personal loan.

Things to consider before applying for a personal loan

Personal loans are a great financial tool. They help in emergencies or in situations where we need a bit more financial freedom but always consider whether that is the right choice for your current situation.

The first thing to consider is do you really need the loan. Is your expense urgent or can it wait until you save up for it? If your expense is urgent, then calculate exactly how much money you need.

Borrow only what you need and can repay comfortably.

The second thing to do is find lenders who offer the type of loan that you need. Using free loan comparison platforms can save you a lot of time finding the right lenders online. Once you find legitimate lenders who offer the amount you need, consider the term of the loan and how much you can afford to pay back every month.

Shorter loan terms = higher monthly payments but less total interest.

Longer loan terms = lower payments but more total interest over time.

Once you have found the right lenders, send your personal loan online application and wait for their reply.

Read the approved loan agreements you get, and compare the APR, the total cost of the loan, the monthly instalments, and when they are due. Also compare the processing fees and late payment penalties. Read the fine print and understand the terms and conditions before you sign the loan agreement.

Take your time, compare options, and borrow responsibly.

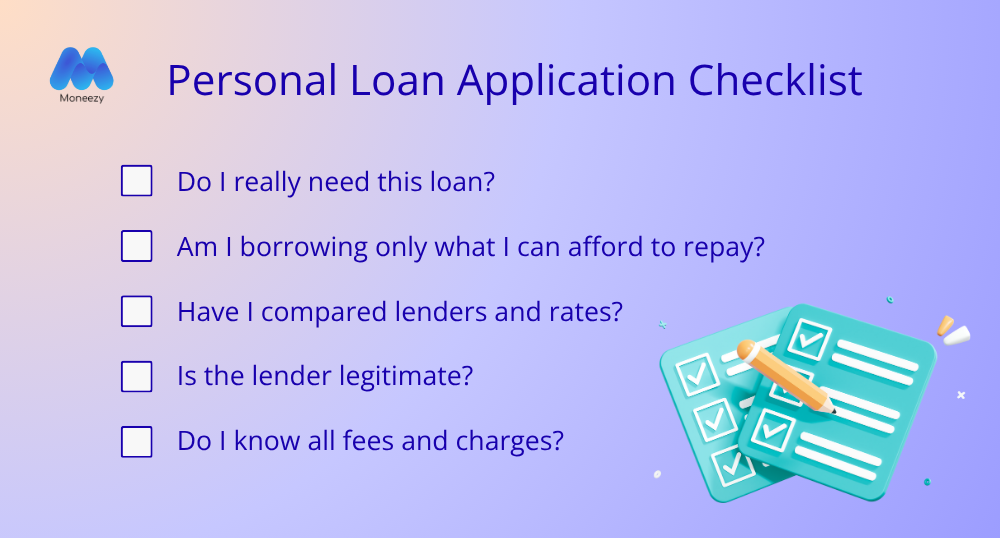

Quick checklist before sending your personal loan application

How to get fast approval of your personal loan?

If you want fast approval of your online loan application, preparation is key.

Prepare the right documents before sending your loan application. Common requirements from lenders in the Philippines include:

Government-issued ID (e.g., Passport, Driver's License, UMID, SSS ID, or PRC ID)

Valid phone number and email address

Proof of income (pay slips, bank statements)

Proof of billing

Make sure to fill out the personal loan application form correctly. Mistakes or missing details only cause delays.

Another good tip is to keep an eye on your phone and email. The lenders may call or send emails to verify information or request extra documents.

Smaller loans are less risky for the lenders and therefore have faster approval.

What online lenders look for in borrowers

It’s crucial for lenders to lend money to the right people so that they can stay in business. Lenders use different criteria to determine if you are a low-risk or high-risk borrower, here are the most common ones:

Credit history

Your credit score shows whether you are good at paying your bills on time. Lenders use this to predict how likely you are to pay off your new loan on time.Income and Employment

A long-term employment contract and a steady income reassure lenders that you can afford your monthly repayments.Age and Legal Eligibility

In the Philippines, to qualify for most personal loans, you need to be at least 18 years old and a Filipino citizen or resident with a billing address.Debt-to-Income Ratio

Some lenders may look at how much of your income already goes toward debts. The less obligations you have, the better your approval chances are.