Table of contents

- Mistake #1: Not checking if the loan app is SEC-registered

- Mistake #2: Overlooking data privacy concerns

- Mistake #3: Overlooking the customer reviews or believing they are all genuine

- Mistake #4: Falling for "low interest" offers and ignoring the true cost of the loan

- How to check if a loan app is legit?

- In conclusion: How to avoid loan app scams in the Philippines

Loan apps make borrowing money fast and convenient. But with dozens of options available, it’s easy to fall into costly traps, from high interest rates to hidden charges. This article breaks down the most common mistakes borrowers make, so you can avoid them and choose a safe, affordable loan.

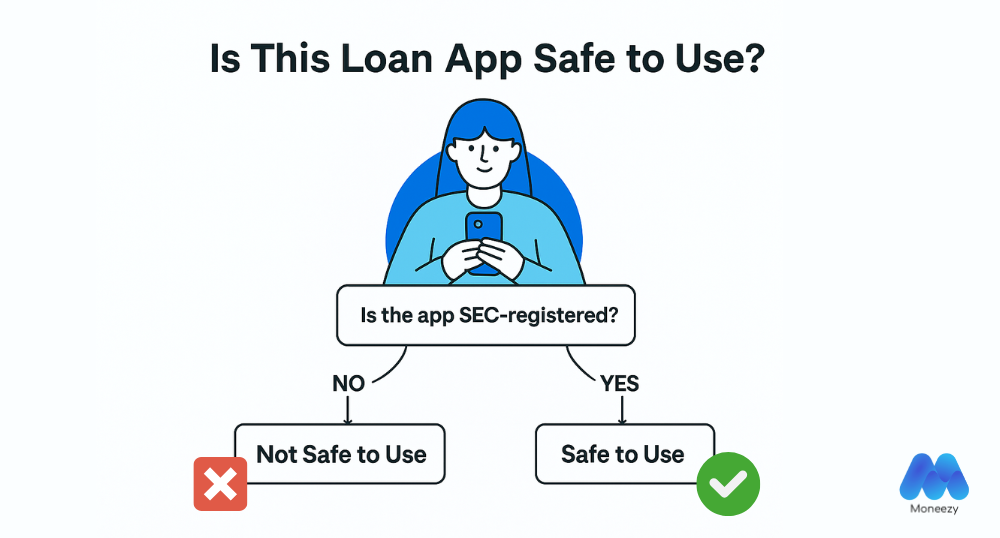

Mistake #1: Not checking if the loan app is SEC-registered

One of the biggest red flags in online lending is using an unregistered lender.

In the Philippines, legitimate lending companies must be registered with the Securities and Exchange Commission (SEC). SEC registration means the lender follows legal guidelines to protect borrowers.

The pitfall: If you apply for a loan from an unregistered app, and if things go wrong, you have no legal recourse. These "loan sharks" are notorious for using aggressive, illegal collection tactics like harassing your contacts, shaming you online, or threatening you and your family.

How to avoid it: Before you download any app, check if the company is on the official list of SEC-registered lending companies. You can find this list on the SEC website.

A legitimate app will proudly display its SEC registration number on its website.

Mistake #2: Overlooking data privacy concerns

A big mistake many people make is not checking what permissions the app is asking for on their phone. Always choose a lender that respects your privacy.

The pitfall: Before your loan is even approved, some apps will ask for access to your contacts, photo gallery, and sometimes even your social media accounts. Fraudulent lenders can use your personal data to harass you and your contacts if you fall behind on your payments. This is illegal, especially under the Data Privacy Act of 2012.

How to avoid it:

Read the permissions: Before you download or open an app, read what data it is requesting access to. If it's asking for permissions that aren't necessary for a loan, such as your gallery, contacts, or location, be careful.

Read the Privacy Policy: A legitimate lender will have a Privacy Policy on their website or app. This document explains how they use your data and who has access to it.

Stick to SEC-Registered Lenders: Legitimate lenders registered with the SEC are required to comply with the Data Privacy Act and can be penalized if they violate it. Never apply for a loan from an app without a clear SEC registration.

Your personal data is valuable and should not be exchanged for a loan.

Mistake #3: Overlooking the customer reviews or believing they are all genuine

The comments and reviews on Google Play, the App Store, and social media are a goldmine of information. They provide insights into other users' experiences with the app and the lender.

The pitfall: You only look at the positive reviews and ignore the one-star ratings that mention issues like hidden fees or privacy violations. These reviews often reveal the harsh reality of dealing with not legit lenders.

Also, keep in mind that some reviews online can be fake or paid.

How to avoid it: Read a mix of reviews. Look for recurring complaints. If multiple people mention that the app accessed their contacts without permission or that they were harassed by collectors, do not download it.

Look for an app that has a high rating and a track record of good customer service.

Mistake #4: Falling for "low interest" offers and ignoring the true cost of the loan

Lending apps often display a low interest rate as a part of their marketing. Unfortunately, this can be misleading.

The pitfall: You see an ad for a loan with a "1% monthly interest rate" and think it's a great deal. However, this is usually a simple interest rate and doesn't account for all the other fees. Watch out for:

Processing fees

Service charges

Penalties for late payments

Advance payment requirements (often requested by not legit lenders)

How to avoid it: Check the Annual Percentage Rate (APR) of the loan, not just the monthly rate. APR is the single most important number that tells you the true cost of borrowing.

A transparent lender will be upfront about the cost of the loan from the start.

How to check if a loan app is legit?

To check if a loan app in the Philippines is legit, start by verifying if it’s registered with the Securities and Exchange Commission (SEC). This ensures the lender complies with local regulations.

Visit the official SEC website and search for the company’s name or registration number.

In conclusion: How to avoid loan app scams in the Philippines

Choosing the right loan app is all about being an informed consumer.

By avoiding these common pitfalls, you can protect your financial health and find a lending solution that genuinely helps you.

Gamitin ang moneezy.ph upang ikumpara ang mga lehitimong lender at maiwasan ang mga scam.

Desi Rasmussen is a FinTech Communication Specialist with more than eight years of experience in FinTech and SaaS industries. She holds a degree in International Marketing and Communication from the University of Southern Denmark and is passionate about writing content that empowering readers to make smart financial choices.