Table of contents

- What is a credit score and why is it important?

- What affects your credit score?

- Why do lenders check your credit score?

- Who calculates your credit score in the Philippines?

- What does Credit Information Corporation (CIC) do?

- What do Private Credit Bureaus (Accredited by CIC) do?

- How to check your credit score in the Philippines?

- Tips to improve your credit score

- FAQs about Credit Score in the Philippines

- Q1: Can I get a loan without a credit score?

- Q2: What is a good credit score in the Philippines?

- Q3: Does checking my score lower it?

- Q4: How long does negative data stay on my credit score report?

- Q5: Can I build a credit score without a credit card?

- Conclusion: Improving your credit score is the way to better loans

"Sir/Ma'am, pasensya na po, hindi po na-approve ang loan n'yo dahil sa credit score n'yo." Have you ever heard this line from a bank or a lending company? If so, you're not alone. For many Filipinos, the term "credit score" might be new and confusing.

Understanding your credit score is your key to unlocking better loan options, lower interest rates, and a more secure financial future. So, ano nga ba ito, at paano mo 'to maa-improve?

What is a credit score and why is it important?

A credit score in the Philippines is a three-digit number that represents a person's creditworthiness, or how likely they are to repay a loan. It’s based on your borrowing history, how you pay bills, outstanding debts, and other financial behaviors.

The higher the score, the more trustworthy you appear to be to banks and lenders.

What affects your credit score?

Your credit score is not a random number. It's calculated based on how you manage your finances. Here are some of the most important factors:

Payment History – Are you paying your loans and credit cards on time?

Credit Utilization – How much of your available credit are you using?

Length of Credit History – How long you’ve been borrowing and repaying loans.

Types of Credit Used – Do you use different types of credit like credit cards and personal loans?

New Credit Inquiries – Too many applications in a short time can hurt your score.

Even unpaid telco bills or missed utility payments could appear on your record if reported to CIC. Good behavior is rewarded, and mistakes can stick around for years, so be mindful.

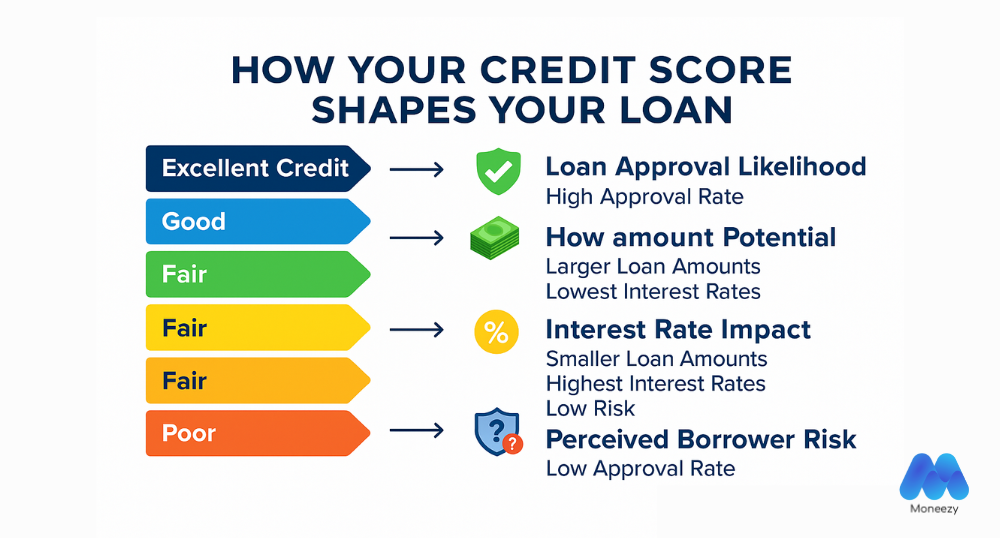

Why do lenders check your credit score?

When you apply for a loan banks and lenders need to assess their risk for lending you money.

Put shortly, they want to know if you'll pay them back on time. Your credit score and credit report serve as their primary basis for this assessment.

A good credit score can lead to:

Higher Loan Approval Rates: Lenders are more confident in approving your application.

Lower Interest Rates: You are considered a lower risk, so they can offer you more favorable terms.

Higher Loan Amounts and Credit Limits: You may be approved for a larger amount of money or a higher credit card limit.

On the flip side, a low credit score can lead to denied applications, higher interest rates, or the need for a guarantor.

Who calculates your credit score in the Philippines?

Credit scoring in the Philippines is a collaboration between a government agency and private credit bureaus. The Credit Information Corporation (CIC), under the Department of Finance, collects credit data from banks, lending companies, cooperatives, and utilities. However, the CIC does not generate your score directly.

Instead, CIC partners with private credit bureaus that are authorized to analyze your data and calculate your credit score. These include:

CIBI Information, Inc.

TransUnion Philippines

CRIF Philippines

Microfinance Information Data Sharing, Inc. (MiDAS)

Each bureau may have its own scoring model, but they generally use similar factors, such as payment history and credit usage, to determine your creditworthiness.

What does Credit Information Corporation (CIC) do?

A government-owned agency under the Department of Finance that manages the country's central credit information system.

Collects data from banks, credit card companies, lending apps, utilities, and cooperatives.

CIC provides raw credit data to private credit bureaus to generate your score.

What do Private Credit Bureaus (Accredited by CIC) do?

Access your credit history from the CIC

Analyze your data (e.g. past loans, on-time payments, etc.)

Generate your credit score

Provide credit reports to lenders and borrowers

CIC generates a Credit Report: A detailed history of your credit accounts, including loans, credit cards, and payment history.

Private Credit Bureaus process CIC data and generate actual credit scores.

How to check your credit score in the Philippines?

Many Filipinos don’t realize they already have a credit record. If you’ve ever used a postpaid mobile plan, had a credit card, or applied for a loan, you likely have one.

You have the right to access your own credit information. Checking it regularly helps you understand what lenders see before approving your loan.

Here’s how you can check your score:

Visit www.creditinfo.gov.ph and follow their steps to request your credit report.

Via Accredited Bureaus

Some accredited bureaus (e.g., CIBI or TransUnion) offer paid reports with added features. You can also check your score through apps that partner with these bureaus. Bring 1 Valid ID if visiting a center in person.

Tips to improve your credit score

Improving your credit score isn't an overnight process, but it's definitely achievable. Here are five practical tips you can start applying today:

Pay your bills on time, every time: This is the most crucial factor in your credit score. Make sure to pay all your financial obligations from credit card bills, loan amortizations, to utility bills before their due dates. Setting up automatic payments can help you avoid missed deadlines.

Manage your debt wisely: Your credit score is affected by how much you owe versus your total credit limit. Try not to max out your credit cards or loan limits. It's best to keep your credit card utilization as low as possible.

Avoid applying for too many loans at once: When you apply for a new loan or credit card, it results in a "hard inquiry" on your credit report. Too many hard inquiries in a short period can negatively impact your score. Therefore, always use comparison platforms like Moneezy, to find personalized loan offers from trusted lenders in the Philippines.

Keep old accounts open: The length of your credit history also plays a role. Long credit history helps build trust. Closing old credit card accounts, even if you don't use them, can shorten your credit history and lower your score. It’s better to keep them open and active, even if you only use them occasionally.

Review your credit report regularly: Errors on your credit report can unjustly lower your score. By checking your report, you can spot and dispute any inaccuracies with the CIC.

Improving your score won’t happen overnight, but consistent, smart habits will pay off over time.

FAQs about Credit Score in the Philippines

Q1: Can I get a loan without a credit score?

Yes, but your options may be limited to higher-interest loans or lenders that don’t require a score.

Q2: What is a good credit score in the Philippines?

While ranges vary by bureau, a score above 700 is generally considered good.

Q3: Does checking my score lower it?

No. Checking your own score is called a “soft inquiry” and does not affect your rating.

Q4: How long does negative data stay on my credit score report?

Typically, 3–5 years, depending on the type of issue.

Q5: Can I build a credit score without a credit card?

Yes. Any loan or bill reported to the CIC counts toward your history.

Conclusion: Improving your credit score is the way to better loans

A good credit score in the Philippines is more than just a number. It’s a gateway to better financial opportunities. A good credit score can help you secure the funding you need with better terms.

Start your journey to better financial health today. And once you're ready to find the best loan for your needs, remember that Moneezy.ph is here to help you compare your best options from legitimate lenders.

Desi Rasmussen is a FinTech Communication Specialist with more than eight years of experience in FinTech and SaaS industries. She holds a degree in International Marketing and Communication from the University of Southern Denmark and is passionate about writing content that empowering readers to make smart financial choices.