Table of contents

- Is Digido SEC-registered? (Last updated: December 17, 2025)

- Why is Digido not SEC-registered? (Last updated: December 17, 2025)

- Digido online loan offers

- Who can get a Digido loan?

- What is the interest rate on a Digido online loan?

- How to apply for a Digido loan online in the Philippines?

- Repayment options

- Why borrow from Digido?

- Does Digido have an app?

- Review - What real borrowers say about Digido loan

- Digido promos in the Philippines

Digido

Digido.ph is an online lending platform in the Philippines that offers fast, fully automated cash loans without the need for collateral. As a SEC-registered lender, Digido ensures safe and transparent lending services for Filipinos who need quick financial assistance.

With loan amounts ranging from ₱1,000 to ₱25,000, Digido caters to both first-time borrowers and repeat clients. First-time applicants can enjoy zero-interest loans (subject to terms), while returning customers can access larger amounts with flexible repayment periods of up to 180 days.

Is Digido SEC-registered? (Last updated: December 17, 2025)

As of May 2025, the Securities and Exchange Commission (SEC) in the Philippines revoked the corporate registration and financing license of Digido Finance Corp., the company operating Digido, UnaCash, and UnaPay. This action effectively shut down its ability to operate legally as a financing company.

Why is Digido not SEC-registered? (Last updated: December 17, 2025)

The revocation of the corporate registration and financing license of Digido was carried out under an order dated May 9, 2025.

The SEC found that Digido had operated four “exhibit booths” in Cavite (Bacoor, Dasmariñas, General Trias, and Kawit) without obtaining the required Certificate of Authority (CA).

The Securities and Exchange Commission (SEC) ruled that even though Digido said its booths were only for marketing, promoting loans on social media made it appear as if they were offering onsite lending, something that requires a proper license.

After the SEC revoked its lending license, Digido filed a motion for reconsideration, arguing that the booths should not be treated as official branches.

Digido online loan offers

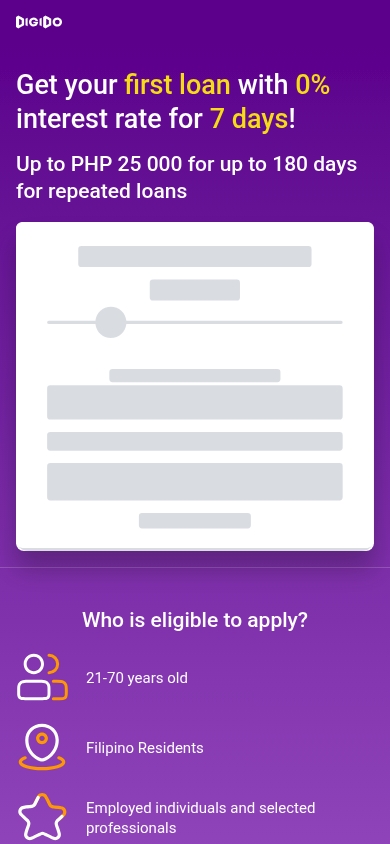

- First-time borrowers can apply for a Digido online loan ranging from ₱1,000 to ₱4,000. Enjoy 0% interest on your first loan for up to 7 days. (subject to terms)

- Returning customers may qualify for larger loan amounts up to ₱25,000. Enjoy flexible repayment terms up to 180 days, making loan payments more manageable.

Who can get a Digido loan?

- Eligibility: Any Filipino citizen aged 21 to 70 years old with an active mobile number can apply for a Digido online loan.

- Required document: At least one valid government-issued ID is needed to proceed with the loan application.

- Increase loan approval chances: Applicants who submit additional supporting documents have higher chances of approval, such as recent payslips, Certificate of Employment (COE), Latest Income Tax Return (ITR), Company ID, DTI registration (for self-employed individuals or business owners)

What is the interest rate on a Digido online loan?

- First-time borrowers – 0% interest rate on your very first Digido loan.

- Returning customers – Interest rates depend on the loan amount and repayment term.

- Interest cap – Rates will not exceed 1.5% per day, ensuring transparent and predictable costs.

How to apply for a Digido loan online in the Philippines?

Getting a Digido online loan is fast and easy. Borrowers can apply completely online using just a valid government-issued ID. The loan application process is simple:

- Select the loan amount you need on the Digido website and click “Apply now”. You will receive a confirmation code in a text message with which you can access an online form and fill out your personal data and submit your ID for verification.

- After completing the form, indicate how you would like to receive the money: bank account, e-wallet or remittance centers.

- Get a loan decision in minutes and sign the contract with Digido via a conformation code, you will receive as a text message.

Digido makes borrowing easy and convenient with minimal requirements and quick approval.

Repayment options

Digido makes repayment convenient through e-wallets like GCash, Maya; bank transfer; and over-the-counter payment centers nationwide, giving borrowers flexibility in managing their dues.

Does Digido engage in harassment when collecting late loan payments?

No, Digido does not practice harassment in collecting payments. The company follows ethical and legal collection practices in the Philippines, ensuring that borrowers are treated with respect.

If you are experiencing problems and cannot repay your loan on the due date, contact Digido for a loan extension.

Why borrow from Digido?

- 100% online process – Apply anytime, anywhere through Digido’s website.

- Fast approval – Many borrowers get approved within minutes.

- No collateral required – Only a valid government-issued ID is needed.

- Multiple customer support options including phone, email, and live chat to assist borrowers effectively.

Does Digido have an app?

Yes. Digido has a mobile app available for both Android and iOS users in the Philippines.

- Android – The Digido app can be downloaded from the Google Play Store.

- iOS – It’s also available on the Apple App Store for iPhone users.

Through the app, borrowers can apply for loans, track repayment schedules, and manage accounts anytime.

Review - What real borrowers say about Digido loan

Borrowers largely appreciate Digido for its fast approval, easy to use platform, and hassle-free experience particularly helpful for emergencies. Many are happy for the opportunity to take the first loan interest-free.

On the downside, some users note that repeat loans can become expensive, which is to be expected due to the long term of the loan.

App Review - Many borrowers say the app is fast and convenient, though some reviews mention occasional technical issues.

Digido promos in the Philippines

Enjoy exciting rewards while applying for your loan online! Digido often runs promotions where clients of the lender can win different prizes.

For example, special offers like the Digido iPhone 15 Pro Max Raffle, where borrowers who take out loans up to ₱25,000 get a chance to win premium prizes. During the holidays, Digido’s 12 Gifts of Christmas promo brings extra bonuses and surprises for loyal customers.

On the lenders website you can stay updated on all Digido’s loan promos and giveaways.